Vol 25/2, 2023, pp. 155-169 PDF

Joo-Young Lee

Abstract

This paper discusses economic inequality as a key social determinant of health. It highlights the potentially transformative role of social protection systems in addressing economic inequality and health inequalities. How to finance social protection and how to distribute benefits among people are key questions in the pursuit of a transformative social protection system that can adequately tackle economic inequalities. This paper argues that a human rights approach can provide a normative orientation in the political process that decides the distribution of burdens and benefits in relation to social protection, calling for an assessment of its impact on socioeconomic inequalities and on disadvantaged groups of people. While the right to social security is at the center of a human rights approach to social protection, the rights to health, education, housing, and work also provide important normative elements for social protection. A human rights-based social protection system requires comprehensive protection for major social risks and challenges throughout the life cycle; universal access to quality services such as health, education, child care, and services for older people or people with disabilities; and a progressive financing mechanism. In this regard, the International Labour Organization’s Social Protection Floors Recommendation No. 202 provides strong guidance on the implementation of the right to social security for all.

Introduction

In the midst of the COVID-19 pandemic, United Nations (UN) Secretary-General António Guterres called for a new social contract and a global new deal in order to address rising inequalities and rebuild solidarity and trust among people.[1] The Secretary-General’s report Our Common Agenda stressed social protection as a key element of the renewed social contract that ensures conditions for all to an adequate standard of living.[2] Tackling economic inequalities was on the global agenda even before the COVID-19 pandemic.[3] However, the pandemic revealed the link between the unequal distribution of health and socioeconomic inequalities in severe ways, highlighting the urgency of a holistic approach to tackle such inequalities.[4] While remote working may have enabled people to keep their jobs and protect their health, there was inequality in access to remote work, with those in high-paid jobs enjoying greater access than those in in low- and middle-skilled jobs.[5] Further, people with limited access to health information, vaccines, and essential care were disproportionately affected by the pandemic. And workers in the informal economy and those in so-called flexible and temporary forms of employment were more affected by the loss of jobs and income. While comprehensive and progressively funded social protection policies and programs helped ameliorate the socioeconomic impacts of the pandemic and mitigate an increase in economic inequality, social protection systems in many countries have long been underfunded and have shown gaps in the availability, accessibility, and adequacy of benefits.[6]

This paper examines how to unlock the transformative potential of a comprehensive human rights-based social protection system to address economic inequality and health inequalities. It begins with a discussion of economic inequality as a major social determinant of health, clearly illustrated by the COVID-19 pandemic and its consequences. It turns to social protection as a “structural driver” of the transformation of economic inequality, and the large gaps in social protection that pose challenges to building and extending social protection. It considers a human rights approach to social protection, which includes the right to social security and its normative content, along with the rights to health, education, and housing. The International Labour Organization’s (ILO) Social Protection Floors Recommendation No. 202 is highlighted as a human rights-based guide to social security. This paper addresses the key question of whether social protection can address both poverty and economic inequalities and discusses the disparate impacts of different forms of social protection schemes on this question. It examines the key elements of transformative social protection and concludes by underscoring the importance of progressive financing of social protection and equitable access to social security benefits in order to build a more equitable society.

Socioeconomic status as a social determinant of health

In 1980, the Report of the Working Group on Inequalities in Health (also known as the Black Report), published by the UK Department of Health and Social Security, demonstrated the unequal distribution of ill health and death among the population of Britain and argued that socioeconomic circumstances such as income, education, housing, diet, employment, and conditions of work were key factors in health inequalities.[7]

In 2008, the World Health Organization Commission on Social Determinants of Health report Closing the Gap in a Generation took a view that health inequities were largely attributable to inequalities in the distribution of power, income, goods, and services, as well as the consequent disparities in people’s living conditions, such as “their access to health care, schools, and education, their conditions of work and leisure, their homes, communities, towns, or cities.”[8] The report called for improving the conditions of daily life and addressing the inequitable distribution of power, money, and resources with a view to achieving equality in health.[9] Guaranteeing fair employment and decent work and building a universal and comprehensive social protection are among 12 goals to that end.[10]

Socioeconomic inequalities and health inequalities during the COVID-19 pandemic

The COVID-19 pandemic shows yet another example of the links between the unequal distribution of health and socioeconomic inequalities. An association between socioeconomic inequalities and noncommunicable diseases has already been well documented.[11] Increasing evidence has been emerging, highlighting the association of socioeconomic deprivation with COVID-19 in its incidence, severity, and mortality. Studies in the United States, India, England, Switzerland, France, and Colombia have shown that people with lower socioeconomic conditions tend to have a higher risk of infection, resulting in wider health inequalities.[12] Undoubtedly, socioeconomic conditions are not the only factor, though.

Clare Bambra et al. suggest that the concept of a “syndemic” is useful in understanding the multiple types of vulnerability of marginalized groups, including people living with greater socioeconomic deprivation during the COVID-19 pandemic.[13] A syndemic refers to a situation where “risk factors or comorbidities are intertwined, interactive and cumulative, adversely exacerbating the disease burden and additively increasing its negative effects.”[14] According to this concept, the overall health of people with higher socioeconomic deprivation was more severely affected by COVID-19 than that of the least deprived, due to a synergistic combination of unequal distribution of chronic diseases, inequalities in working and living conditions, limited access to social protection, and unequal access to health care services. People working in essential services sectors (such as food, cleaning, health care, delivery, and public services), people working in informal economies, and people in a precarious form of employment had a greater risk of exposure to infection because they were likely to continue to commute and work in person.[15] Overcrowded and poor-quality housing conditions also contributed to increasing the risk of infection.[16] In addition, limited access to quality health care and health information during the pandemic may have contributed to more adverse outcomes among people with disadvantaged socioeconomic backgrounds.[17] Moreover, marginalized groups, including people with greater socioeconomic deprivation, tend to have higher rates of underlying health conditions that increase the severity and mortality of COVID-19 compared to the least deprived; this, in turn, is an outcome of socioeconomic inequalities.[18]

Worsening economic inequalities during the health crisis

Many countries implemented various measures to contain the pandemic, including travel restrictions, the closure of schools and workplaces, restrictions on gatherings, and shelter-in-place orders. Again, the impacts of those measures and subsequent economic recessions were not evenly distributed among people. The ILO estimated that pandemic-related restrictions and economic recessions caused an unprecedented loss of 255 million full-time jobs worldwide in 2020, which was about four times greater than during the global financial crisis in 2009.[19] The job losses affected workers with lower skills more than those with higher skills.[20] Micro and small enterprises and informal workers were also hit harder by the crisis.[21] While the disruption to the labor market affected both men and women, women’s employment fell by 5%, compared with 3.9% for men, and the increase in unpaid work, such as child care and housework, fell disproportionately on women.[22] The rate of decline in employment among young people was 2.5 times greater than that among adult workers.[23] Moreover, the unequal disruption to education during the pandemic is expected to have longer-term negative impacts on jobs, wages, and skills development, creating new inequalities among cohorts of children and young people.[24]

These uneven impacts of the crisis aggravated existing economic inequalities and generated new ones. According to Oxfam, the richest 1% reaped about 63% of new wealth created between 2020 and 2021, which is six times more than the total new wealth gained by people in the bottom 90%.[25] The World Bank announced that the COVID-19 pandemic in 2020 appeared to have caused the largest single-year increase in global inequality and the largest increase in global poverty since World War II, putting 71 million more people in extreme poverty compared to the previous year.[26] In July 2023, a group of leading economists, including Joseph Stiglitz, Jayati Ghosh, and Thomas Piketty, called on the UN and the World Bank to do more to combat rising extreme inequality, highlighting that “following the COVID-19 pandemic and now the global cost of living crisis, inequalities have worsened, by many measures.”[27]

Social protection: Key instrument for reshaping economic inequality

Rising economic inequality is not inevitable and is an outcome of political choices about how far inequality can be tolerated. Unequal living and working conditions that are closely linked with health inequalities are in fact the consequences of a combination of policies, economic arrangements, and politics.[28] In discussing the social determinants of health, the Commission on Social Determinants of Health also highlights tackling “these structural drivers” of socioeconomic conditions as one of the three principles of action to achieve health equity.[29] Social protection is indeed among the key structural drivers that determine economic inequalities and in turn health inequalities, by way of reshaping the distribution of power, money, and resources.

Global call for social protection systems in the post-pandemic context

The pandemic has highlighted more than ever the need for a robust social protection system, including income protection, family and child support, and health care. It is evident that emergency measures are necessary to alleviate the impacts on vulnerable groups of people during health, economic, or natural crises. However, without a comprehensive pre-crisis social protection system, such measures are unlikely to respond adequately to the crisis in a timely manner. The UN High Commissioner for Human Rights has noted that “countries that had invested in quality public services through universal and comprehensive healthcare and social protection system have proven to be more resilient.”[30]

For example, during the pandemic, sick leave and sickness benefits played an important role in protecting individuals, their families, and the public, as well as ensuring income security in the event of ill health. Unemployment benefits were critical in protecting individuals from poverty and vulnerability during the economic recession. Affordable, good-quality child care and education are critical for closing the gaps in children’s development and future earnings. Access to affordable, quality health care certainly had an impact on health inequalities during the pandemic.[31] As the UN Secretary-General stressed, “countries which had comprehensive social protection systems in place prior to the crisis, which was the case only for a minority of States, were able to quickly organize necessary support by scaling up or adapting operation.”[32] Luxembourg was such an example, where the existing strong unemployment benefit was well equipped to protect individuals from income loss against unemployment and short-time work, thus mitigating an increase in income inequality.[33] The changes made to the scheme during the pandemic were mainly aimed at simplifying a procedure to speed up the cash flow and expanding eligibility for the scheme.[34]

It is therefore unsurprising that not only the UN Secretary-General but also other international organizations emphasized social protection in their recommendations for recovering from the COVID-19 crisis.[35] In a global call to action for a human-centered recovery, the ILO reminded all countries of its call to achieve universal social protection, along with the specific measures to promote quality employment, ensuring that an economic and social recovery is fully inclusive, sustainable, and resilient.[36] The World Bank also stressed the need for universal social protection systems, highlighting the role of social protection in providing safeguards against the shocks of the crisis and reducing inequalities, especially for poor and vulnerable people.[37] UNICEF, jointly with the ILO, called on countries to expedite progress toward universal social protection.[38]

Concepts of social protection

It is only in recent decades that the term “social protection” came into wide use in both developing and developed countries.[39] The ILO began its standard-setting work on social security before World War II, and the Universal Declaration of Human Rights of 1948 embodied the right to social security. However, social security had long been viewed as pertaining exclusively to high-income countries.[40] Beginning in the 1980s, the World Bank and the International Monetary Fund started supporting “social safety nets,” a more limited range of targeted programs, for developing countries, mainly to mitigate the adverse effects of structural adjustments on vulnerable groups of people.[41] However, globalization, accompanied by increased inequality and economic volatility, required the development of national policies and programs of a permanent and comprehensive nature in order to protect people from vulnerability, risks, and deprivation.[42] In this context, social protection has gained global attention as a means to combat poverty and reduce inequality. As a result, social protection systems have become an essential part of the 2030 Agenda for Sustainable Development (for instance, see Targets 1.3, 5.4, and 10.4).

There is no uniformly accepted definition or form of social protection. The ILO uses “social protection” and “social security” interchangeably and defines social protection in broad terms as “the set of policies and programmes designed to reduce and prevent poverty and vulnerability across the life cycle.”[43] The main areas of social protection include “child and family benefits, maternity protection, unemployment support, employment injury benefits, sickness benefits, health protection, old-age benefits, disability benefits and survivors’ benefits.”[44] Each of these areas can be funded either from contributions or through general taxation, or a combination of both.

Large gaps in social protection

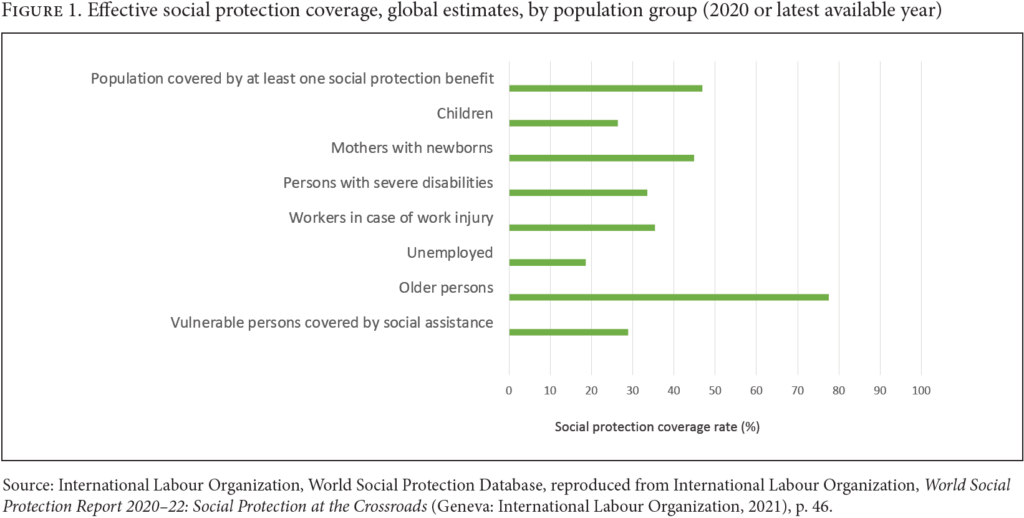

Despite the significant progress in building and extending social protection in many parts of the world over the last two decades, large gaps remain. According to the ILO, more than half of humanity, as many as 4.1 billion people, are left unprotected, with only 46.9% of the global population effectively covered by at least one social protection benefit (excluding health care and sickness benefits).[45] Only 26.4% of children worldwide receive social protection benefits.[46] Among the working-age global population, only 30.6% are legally covered by “comprehensive social security systems including a full range of benefits from child and family benefits to old-age pension.”[47] The gap is particularly wide for unemployment benefits, which only 18.6% of the world’s unemployed effectively receive.[48] Only about 39% of the world’s working-age population is legally entitled to income security by way of paid sick leave, sickness benefits, or a combination of both.[49] Income protection during sickness effectively covers only a third of the working-age population across the world. (See Figure 1.)

The ILO has identified three major challenges in closing persistent gaps in social protection coverage. First, the high levels of informal labor and the growth of so-called flexible forms of work are a key impediment.[50] People making their living in the informal economy account for more than 60% of the global employed population, and the majority of them do not have access to adequate income protection and health care.[51] Since the classical social protection system was initially premised on standard forms of employment, many individuals in part-time, temporary, self-employed, or so-called new forms of employment tend to have limited or no access to social protection, depending on the relevant national policy and legal framework.[52] This issue is cross-cutting across other key areas of gaps. Second, migrant workers and forcibly displaced persons and their families often experience dual challenges in access to social protection because many countries do not guarantee equal treatment between nationals and non-nationals in social protection, and many migrants work in the economic sector characterized by lower social protection.[53] Third, women continue to enjoy lower levels of social protection than their male counterparts, which is the result of “the persistent patterns of inequality” in the world of work—that is, women’s “higher levels of part-time and temporary work and of informal employment (especially informal self-employment), gender pay gaps and a disproportionately high share of unpaid care work.”[54]

In addition to legal barriers to social protection, there are also practical barriers that prevent individuals from accessing social security benefits that they are legally eligible for. The Special Rapporteur on extreme poverty and human rights, Olivier De Schutter, considers that non-take-up is prevalent.[55] Although it is difficult to track the exact trend of this phenomenon due to the lack of monitoring by governments, the existing study on member states of the European Union indicates that the rate is over 40% for all social benefits considered.[56] The prevalence of non-take-up may be linked with a number of factors, such as “a lack of awareness of the benefits themselves (especially due to language and literacy barriers), lack of information about eligibility criteria, difficulties with completing application forms, low amount or unpredictable disbursements and stigmatization when engaging with public administrations.”[57] De Schutter stresses that whatever the reasons are, “non-take-up is a failure of the social protection system, not of the individual,” and significantly limits the impact of the social protection system on the reduction of poverty and inequalities.[58] Overcoming these legal and practical barriers is crucial to ensure access to social security for all individuals.

A human rights approach to social protection

In this context, it is important to revisit a human rights approach to social protection. First, the right to social security is recognized in major human rights instruments, including articles 22 and 25 of the Universal Declaration of Human Rights and article 9 of the International Covenant on Economic, Social and Cultural Rights (ICESCR).[59] The right to social security aims at guaranteeing human dignity for all persons in the circumstances of social risks and challenges across the life cycle, and it provides a firm normative basis for the requirement of comprehensive universal coverage for protection against social risks. Second, international human rights law also recognizes the rights to health, education, housing, water and sanitation, and family protection, and requires that goods and services necessary for the realization of these rights be made accessible and economically affordable for all.[60] Third, state parties’ obligation to take steps, to the maximum of their available resources, with a view to achieving progressively the full realization of economic, social, and cultural rights under the ICESCR (article 2(1)) requires them to review the manner in which social protection is funded and to pursue progressive financing of social protection based on income and wealth. Furthermore, the rights to work and to just and favorable working conditions require broader socioeconomic policies that increase opportunities for decent work and ensure equal pay for work of equal value, which should be an essential companion to social protection systems.[61] Since the right to social security should be at the center of a social protection system, the section below elaborates on the right, along with the concept of the maximum available resources in the ICESCR, drawing on the Committee on Economic, Social and Cultural Rights’ General Comment 19 and its concluding observations.

The right to social security as a human right

Social protection (social security) systems that states adopt to ensure the right to social security may vary depending on the national context. Nonetheless, state parties to the ICESCR must integrate key elements of the right to social security, which are described by the Committee on Economic, Social and Cultural Rights in General Comment 19.[62]

First, the right to social security requires comprehensive protection against all major social risks and challenges across the life cycle and therefore entails, among other things, protection from “(a) lack of work-related income caused by sickness, disability, maternity, employment injury, unemployment, old age, or death of a family member; (b) unaffordable access to health care; [and] (c) insufficient family support, particularly for children and adult dependents.”[63] Second, benefits, whether in cash or in kind, must be adequate in amount and duration so that everyone can realize their rights to family protection, to an adequate standard of living, and to health.[64] Third, state parties should ensure the accessibility of social protection in terms of coverage (everyone, including the most disadvantaged and marginalized groups, should have access to social security without discrimination); eligibility (conditions for benefits must be reasonable, proportionate, and transparent); affordability (in the case of contributory system); participation and information (the social protection system must be designed and administered in a manner than ensures access to information, participation, and accountability); and physical access.[65] In particular, the right to social security calls for attention to groups who are largely marginalized or excluded from traditional social security systems—for example, women who shoulder the disproportionate burden of unpaid care work; part-time, casual, self-employed, and home workers; informal workers; Indigenous peoples and ethnic minorities; and migrant and undocumented workers.[66] Essentially, the right to social security requires a comprehensive social protection system that ensures the universality of coverage and the availability and adequacy of benefits that can provide effective protection in the event of social risks and contingencies, with particular attention to the most marginalized groups.

The systems may involve a mix of contributory schemes (social insurance) and non-contributory tax-funded schemes, including a universal benefit for everyone who experiences a particular risk or social assistance targeted for those in a situation of need.[67] What is important is to ensure that these social security schemes are progressively financed and redistribute resources and services equitably in favor of persons in lower income brackets and other disadvantaged groups. This interpretation can derive from the obligation of state parties under the ICESCR to take measures, to the maximum of their available resources, to make progress in realizing the right to social security. In this way, as the Committee on Economic, Social and Cultural Rights notes, “social security, through its redistributive character, plays an important role in poverty reduction and alleviation, preventing social exclusion and promoting social inclusion.”[68] In relation to the concept of the maximum of available resources, the committee has increasingly recommended that state parties enhance the progressivity of their fiscal and tax policies and increase budget allocations in areas such as social security, health care, and education.[69] Along the same line, a more focused examination may be necessary for the issue of financing the right to social security.

The ILO’s Social Protection Floors Recommendation

The Social Protection Floors Recommendation (No. 202), adopted in 2012 by ILO member states together with representatives of workers and employers, was a significant step toward implementing a comprehensive human rights-based social protection system. The recommendation clearly articulates the right to social security and key elements of human rights approaches as guiding principles. Principles that states should apply in the fields of social protection include the universality of protection; entitlements based on legislation; the adequacy of benefits; nondiscrimination, gender equality, and responsiveness to special needs; social inclusion, including of persons in the informal economy; respect for the rights and dignity of people; solidarity in financing; financial, fiscal, and economic sustainability with due regard to social justice and equity; and coherence with social, economic, and employment policies.[70]

Since the ILO’s founding in 1919, social security has been an important part of the organization. The Declaration of Philadelphia, which became part of the ILO Constitution, recognizes the “solemn obligation of the International Labour Organization to … achieve,” among others, “the extension of social security measures to provide a basic income to all in need of such protection and comprehensive medical care,” as well as “provision for child welfare and maternity protection.” The ILO social security standards provided guidance on the establishment of social security systems. However, the early social security standards, including the 1952 Social Security (Minimum Standards) Convention (No. 102), were biased toward male bread-winners working under the full-time, standard employment model, which reflected the conditions of developed countries when the convention was drafted.[71] As a result, they did not provide adequate guidance on social protection gaps for those in the informal economy, those in non-standard forms of employment, and women.

Recommendation No. 202 intends to “provide states with a guideline for eliminating these and other gaps in the implementation of the right to social security.”[72] It encourages states to build social protection floors that guarantee basic social security, which entails access to essential health care, including maternity care, that meets the criteria of availability, accessibility, acceptability, and quality; basic income security for children, at least providing access to nutrition, education, care, and any other necessary goods and services; basic income security for persons of working age who are unable to earn sufficient income, in particular in cases of sickness, unemployment, maternity, and disability; and basic income security for older persons.[73] These social protection floors are in effect the minimum essential levels of the right to social security that states are required to implement as a priority.[74] Through these social protection floors, (1) all people living in a country should have access to a nationally defined set of essential health care services; (2) all children should be ensured basic income security so as to access to nutrition, education, and health care; (3) people of working age should have income protection in case of ill health, insufficient income, and unemployment; and (4) people in old age and with disability should have income protection for a life with dignity.

The guarantee of social protection floors would significantly contribute to addressing the large gaps in social security and combatting poverty. However, this concept of social protection floors is likely to have limited effects on reducing economic inequalities, and, as suggested by Beth Goldblatt, “retains a minimalist approach to rights that fails to challenge the underlying systemic inequalities of the international economic system.”[75] Therefore, it is of critical importance that social protection floors be complemented by social security schemes that provide adequate levels of protection for a large segment of the population, including the middle class, as well as progressive financing. In this respect, Recommendation No. 202 does not stop at social protection floors. States are further called on to “seek to provide higher levels of protection as many as possible, … and as soon as possible,” which concretizes states’ obligations to take steps progressively toward the full realization of the right to social security.[76] Importantly, Recommendation No. 202 sets out “solidarity in financing while seeking to achieve an optimal balance between the responsibilities and interests among those who finance and benefit from social security schemes” as one of the principles.[77] According to the ILO, solidarity financing entails “vertical redistribution from high-to lower-income households … through progressive personal income tax rates or contribution rates that are proportional to income,” as well as “horizontal redistribution, for instance between healthy and sick persons, men and women, younger and older persons or families with and without children.”[78]

Social protection and economic inequality

Differing impacts of social protection systems on economic inequality

It is commendable that reducing inequality has been identified as one of the Sustainable Development Goals and that social protection has been explicitly recommended as a vital policy to achieve this. It is also encouraging that international organizations, including the World Bank, emphasize universal social protection. However, it should be noted that social protection does not necessarily lead to a decrease in economic inequality.

In many developing countries, social protection has focused largely on targeted programs, namely safety nets for people living in poverty and other vulnerable situations.[79] Under this approach, “social policies were conceived of primarily as residual interventions to address market failures or to assist those adversely affected by crisis or unable to benefit from growth.”[80] Such targeted social protection programs have a positive impact on alleviating extreme poverty to a certain extent, but their impact on economic inequality is not clear. An assessment of social protection systems in Latin America from 2003 to 2013 found that targeted programs contributed to reducing poverty but were less effective in reducing income inequality than universal social protection programs.[81] It suggested that the impact of redistribution was largest in countries with comprehensive social protection systems encompassing universal access to health and education, high social spending, and progressive benefits.[82]

In 2010, a study by the UN Research Institute for Social Development compared the impact on poverty and inequality of the three welfare state regime models in developed countries—that is, conservative, liberal, and social democratic—employing Gøsta Esping-Andersen’s typology of welfare states.[83] It found that the rates of both poverty and income inequality were most significantly reduced in countries where “a wider range of health, education and care services, as well as social protection benefits and transfers, are provided publicly and universally by the state on the basis of citizenship or residence.”[84] An earlier study on the redistributive effects of welfare state institutions among developed countries also suggested that poverty and inequality can be more effectively reduced with universalist (encompassing) approaches to social protection than with low-income targeting.[85]

The funding model is another critical factor that shapes a social protection system’s impact on economic inequality. Social protection systems are typically funded through a mix of social insurance contributions and taxes. Progressivity in mobilizing resources and distributing benefits, whether through contributions or non-contributions, is imperative for enhancing the transformative potential of social protection to address economic inequality. For instance, if revenue for social protection mainly comes from value-added tax, with marginal support from income taxes, it can significantly limit the redistributive effects of social protection.[86] Similarly, if public expenditure is mainly allocated toward subsidizing social protection schemes linked to formal sector employment, instead of social assistance or essential social services, it can sustain or even exacerbate economic inequality.

Social insurance schemes funded through contributions by employers and workers also continue to be an important means of financing that seeks to pool and redistribute risks and benefits within and between generations.[87] Health care can be designed to have an equitable distribution effect, with funding mainly generated from contributions. For example, individuals and employers are required to contribute to health care based on their income and wealth, but health care services are made accessible to all people in society, irrespective of their ability to contribute.[88]

A caveat should be made to the suggestion that a social protection system funded primarily by general taxation can ensure an adequate standard of living for all and reduce economic inequality. The World Bank, which used to promote a targeted safety net approach in developing countries, has become an advocate of a universal basic income. The 2019 World Development Report proposed expanding social assistance (e.g., through a guaranteed minimum income, a mandated savings and insurance plan, and privately managed individual savings) and reducing social insurance, arguing that the social insurance model is ill-suited in the context of growing non-standard employment and large informal economies.[89] The ILO has expressed concern that this proposal for “‘minimum social insurance’, achieved through cuts to employers’ contributions, would result in increased levels of inequality and endanger the sustainability of social protection systems.”[90] A universal minimum guarantee of social protection is a good thing. But if it is coupled with a weakening of the public social insurance system and a growing dependence on private insurance, it can lead to a social protection system that coexists with rising inequality. Closing the wide social protection gaps resulting from the substantial informal economy would require a two-track approach that integrates both contributory and non-contributory systems.[91] One track involves encouraging the transition of informal workers to the formal economy through the creation of more decent job opportunities, and extending social insurance schemes to those workers. Simultaneously, a universal minimum social protection should provide basic income security and access to social services for all, including those who engage in the informal economy.

The transformative potential of social protection in reducing economic inequality

Meeting the objective of expanding social protection to decrease economic inequality, as adopted in the Sustainable Development Goals, necessitates a transformative approach to social protection.[92] Human rights can provide a normative ground for the pursuit of a transformative social protection system that can address economic inequalities. Katja Hujo suggests that “universal and adequate social protection schemes that are progressively financed redistribute risks, income and resources in ways which favour groups with lower incomes, status, or other disadvantages, leading to more equitable social outcomes and empowerment while also fostering cross-class coalitions.”[93] Goldblatt stresses that “progressive taxation that increases with income alongside generous social security transfers, usually to those in need, play a key role in reducing economic inequality, in addition to measures such as minimum wages and the provision of goods and services such as health care and housing.”[94] Furthermore, identifying and addressing the structural conditions that give rise to poverty and inequality is required for social protection to be transformative.[95]

In essence, the transformative potential of social protection systems in reducing economic inequality can be enhanced if social protection is based on human rights, particularly the right to social security, as well as the rights to health and education, which require (1) comprehensive universal coverage for protection against social risks; (2) universal access to quality social services, such as health care, education, child care, and services for older people or people with disabilities; and (3) the progressive financing of social protection based on income and wealth, whether it is contributory or non-contributory. Moreover, social protection measures must be accompanied by wider social and economic policies, since relying solely on a social protection system is inadequate.

Conclusion

Economic inequality is a key social determinant of health. This paper has highlighted the central importance of social protection in ensuring an adequate standard of living for all and reducing economic inequality. International human rights law provides a normative foundation for a transformative social protection system. While the right to social security is at the center of this human rights-based approach to social protection, the rights to health, education, housing, and water and sanitation should also be an important part. Not all forms of social protection, however, tackle both poverty and economic inequality. This paper has discussed the key components of a human rights-based social protection framework that can reshape the distribution of resources and benefits toward a more equal society. These components include comprehensive protection for major social risks and challenges throughout the life cycle; universal access to basic quality services such as health, education, child care, and services for older people or people with disabilities; and a progressive financing mechanism, whether contributory, noncontributory, or of another form. The ILO Social Protection Floors Recommendation No. 202 provides concrete guidance for the realization of the transformative potential of social protection.

Political processes at the national level are what ultimately determine the mobilization of revenue, expenditure allocation, financing mechanisms for social protection, and the design of social security schemes. A major challenge that lies with those processes is that they are “often dominated by elite groups,” and the outcome thereof may not lead to a human rights-based social protection system.[96] In fact, in more unequal societies, due to existing unequal power relations, it is more difficult to have social protection systems that can tackle economic inequalities.[97] A human rights approach can contribute to this struggle for equality by requiring that the impact of any social protection decision on socioeconomic inequalities and on disadvantaged groups be taken into account. It is also important to recognize that building a fairer and more inclusive society also requires addressing the ex ante situation of market income inequalities and creating fair opportunities, and not only ex post redistribution through social protection.[98] In this regard, a human rights approach to social protection has to be closely linked to the rights to work and decent working conditions.

Joo-Young Lee, PhD, is an associate research professor at Seoul National University Human Rights Center, South Korea, and a member of the United Nations Committee on Economic, Social and Cultural Rights.

Please address correspondence to the author. Email: jooyounglee@snu.ac.kr.

Competing interests: None declared.

Copyright © 2023 Lee. This is an open access article distributed under the terms of the Creative Commons Attribution Non-Commercial License (http://creativecommons.org/licenses/by-nc/4.0/), which permits unrestricted non-commercial use, distribution, and reproduction in any medium, provided the original author and source are credited.

References

[1] United Nations Secretary-General, “Tacking the Inequality Pandemic: A New Social Contract for a New Era” (July 18, 2020), https://www.un.org/sg/en/content/sg/statement/2020-07-18/secretary-generals-nelson-mandela-lecture-%E2%80%9Ctackling-the-inequality-pandemic-new-social-contract-for-new-era%E2%80%9D-delivered.

[2] United Nations Secretary-General, Our Common Agenda (New York: United Nations, 2021), pp. 22–28.

[3] Notably, see Sustainable Development Goal 10: Reduce inequality within and among countries. For scholarly discussion, see G. MacNaughton, D. Frey, and C. Porter (eds), Human Rights and Economic Inequalities (Cambridge: Cambridge University Press, 2021).

[4] F. Ahmed, N. Ahmed, C. Pissarides, and J. Stiglitz, “Why Inequality Could Spread COVID-19,” Lancet Public Health 5/5 (2020); C. Bambra, J. Lynch, and K. E. Smith, The Unequal Pandemic: COVID-19 and Health Inequalities (Bristol: Policy Press, 2021); United Nations Secretary-General, Report to the Human Rights Council: Question of the Realization of Economic, Social and Cultural Rights in All Countries; The Impact of the Coronavirus Disease (COVID-19) on the Realization of Economic, Social and Cultural Rights, UN Doc. A/HRC/46/43 (2021), para. 1; United Nations High Commissioner for Human Rights, Report to the Economic and Social Council: Economic, Social and Cultural Rights, UN Doc. E/2020/63 (2021), paras. 5–7.

[5] M. Sostero, S. Milasi, J. Hurley, et al., Teleworkability and the COVID-19 Crisis: A New Digital Divide? (European Commission and Eurofound, 2020); T. Schraepen, L. Nurski, and M. Krystyanczuk, “Uptake and Inequality of Telework Dashboard” (February 13, 2023), https://www.bruegel.org/publications/datasets/uptake-and-inequality-of-telework-dashboard.

[6] International Labour Organization, World Social Protection Report 2020–22: Social Protection at the Crossroads; In Pursuit of a Better Future (Geneva: International Labour Organization, 2021).

[7] A. M. Gray, “Inequalities in Health: The Black Report; A Summary and Comment,” International Journal of Health Services 12/3 (1982).

[8] Commission on the Social Determinants of Health, Closing the Gap in a Generation: Health Equity

through Action on the Social Determinants of Health (Geneva: World Health Organization, 2008), p. 1.

[9] Ibid., p. 2.

[10] Ibid., p. 7.

[11] J. P. Mackenbach, I. Stirbu, A.-J. Rosakam, et al., “Socioeconomic Inequalities in Health in 22 European Countries,” New England Journal of Medicine 358/23 (2008); A. R. Hosseinpoor, L. A. Parker, E. T. d’Espaignet, and S. Chatterji, “Socioeconomic Inequality in Smoking in Low-Income and Middle-Income c

Countries: Results from the World Health Survey,” PLoS One 7/8 (2012); S. Lago, D. Cantarero, B. Rivera, et al., “Socioeconomic Status, Health Inequalities and Non-Communicable Diseases: A Systematic Review,” Zeitschrift fur Gesundheitswissenschaften 26/1 (2018).

[12] N. M. Lewis, M. Friedrichs, S. Wagstaff, et al., “Disparities in COVID-19 Incidence, Hospitalizations, and Testing, by Area-Level Deprivation—Utah, March 3–July 9, 2020,” Morbidity and Mortality Weekly Report 69 (2020); M. K. Goyal, J. N. Simpson, M. D. Boyle, et al., “Racial and/or Ethnic and Socioeconomic Disparities of SARS-CoV-2 Infection among Children,” Pediatrics 146/4 (2020); D Quan, L. Luna Wong, A. Shallal, et al., “Impact of Race and Socioeconomic Status on Outcomes in Patients Hospitalized with COVID-19,” Journal of General Internal Medicine 36 (2021); A. Ossimetha, A. Ossimetha, C. M. Kosar, and M. Rahman, “Socioeconomic Disparities in Community Mobility Reduction and COVID-19 Growth,” Mayo Clinic Proceedings 96/1 (2021); A. Das, S. Ghosh, K. Das, et al., “Modeling the Effect of Area Deprivation on COVID-19 Incidences: A Study of Chennai Megacity, India,” Public Health 185 (2020); S. de Lusignan, J. Dorward, A. Correa, et al., “Risk Factors for SARS-CoV-2 among Patients in the Oxford Royal College of General Practitioners Research and Surveillance Centre Primary Care Network: A Cross-Sectional Study,” Lancet Infectious Diseases 20/9 (2020); V. Mishra, G. Seyedzenouzi, A. Almohtadi, et al., “Health Inequalities during COVID-19 and Their Effects on Morbidity and Mortality,” Journal of Healthcare Leadership 13 (2021), p. 21; J. Riou, R. Panczak, C. L. Althanus, et al., “Socioeconomic Position and the COVID-19 Care Cascade from Testing to Mortality in Switzerland: A Population-Based Analysis,” Lancet Public Health 6/9 (2021); S. Vandentorren, S. Samili, E. Chatignoux, et al., “The Effect of Social Deprivation on the Dynamic of SARS-CoV-2 Infection in France: A Population-Based Analysis,” Lancet Public Health 7/3 (2022); M. P. Cifuentes, L. A. Rodriguez-Villamizar, M. L. Rojas-Botero, et al., “Socioeconomic Inequalities Associated with Mortality for COVID-19 in Colombia: A Cohort Nationwide Study,” Journal of Epidemiology and Community Health 75 (2021).

[13] C. Bambra, R. Riordan, J. Ford, and F. Matthews, “The COVID-19 Pandemic and Health Inequalities,” Journal of Epidemiology and Community Health 74 (2020).

[14] Ibid., p. 965.

[15] Ibid.; Goyal et al. (see note 12); Vandentorren et al. (see note 12); Cifuentes et al. (see note 12).

[16] Vandentorren et al. (see note 12); Cifuentes et al. (see note 12); Bambra et al. (2020, see note 13).

[17] Cifuentes et al. (see note 12); Mishra et al. (see note 12); Bambra et al. (2020, see note 13).

[18] Bambra et al. (2020, see note 13).

[19] International Labour Organization, ILO Monitor: COVID-19 and the World of Work, seventh edition (January 25, 2021), p. 1.

[20] International Labour Organization, World Employment and Social Outlook: Trends 2021 (June 2021), p. 112.

[21] Ibid.

[22] Ibid.

[23] Ibid.

[24] F. H. G. Ferreira, “Inequality in the Time of COVID-19,” Finance and Development (2021), p. 23.

[25] Oxfam, Survival of the Richest: How We must Tax the Super-Rich Now to Fight Inequality (Oxford: Oxfam International, 2023), p. 8.

[26] World Bank, Poverty and Shared Prosperity 2022: Correcting Course (Washington, DC: World Bank, 2022), pp. 53, 83.

[27] “Open Letter to the United Nations Secretary-General and President of the World Bank: Setting Serious Goals to Combat Inequality,” https://equalshope.org/index.php/2023/07/17/setting-serious-goals-to-combat-inequality/; L. Elliott, “Top Economists Call for Action on Runaway Global Inequality,” Guardian (July 17, 2023).

[28] Commission on the Social Determinants of Health (see note 8), p. 26.

[29] Ibid.

[30] United Nations High Commissioner for Human Rights (see note 4), para. 3.

[31] Bambra et al. (2021, see note 4), pp. 81–86.

[32] United Nations Secretary-General, Question of the Realization in All Countries of Economic, Social and Cultural Rights, UN Doc. A/HRC/49/28 (2022), para. 11.

[33] D. M. Sologon, C. O’Donoghue, I. Kyzyma, et al., “The COVID-19 Resilience of a Continental Welfare Regime: Nowcasting the Distributional Impact of the Crisis,” Journal of Economic Inequality 20 (2022).

[34] Ibid., p. 783.

[35] United Nations Secretary-General (2020, see note 1).

[36] International Labour Organization, Global Call to Action for a Human-Centred Recovery from the COVID-19 Crisis That Is Inclusive, Sustainable and Resilient (Geneva: International Labour Organization, 2021).

[37] World Bank, Charting a Course towards Universal Social Protection: Resilience, Equity, and Opportunity for All (Washington, DC: World Bank, 2022), p. IX.

[38] UNICEF and International Labour Organization, More Than a Billion Reasons: The Urgent Need to Build Universal Social Protection for Children (Geneva and New York: UNICEF and International Labour Organization, 2023).

[39] Overseas Development Institute, Social Protection Concepts and Approaches: Implications for Policy and Practice in International Development (2001), p. 21.

[40] Ibid.

[41] Independent Evaluation Group, “Appendix A: History of Social Safety Nets at the World Bank,” Social Safety Nets: An Evaluation of World Bank Support, 2000– 2010 (Washington, DC: World Bank Group, 2011), pp. 85–98.

[42] Overseas Development Institute (see note 39), pp. 7–9.

[43] International Labour Organization, World Social Protection Report 2017–19: Universal Social Protection to Achieve the Sustainable Development Goals (Geneva: International Labour Organization, 2017), p. 2.

[44] Ibid.

[45] International Labour Organization (2021, see note 6), p. 45.

[46] Ibid., p. 47.

[47] Ibid., p. 55.

[48] Ibid., p. 158.

[49] Ibid., p. 122.

[50] Ibid., p. 49.

[51] Ibid.

[52] Ibid., pp. 49–51.

[53] Ibid., pp. 53–54.

[54] Ibid., pp. 54–55.

[55] Special Rapporteur on Extreme Poverty and Human Rights, Report on Non-Takeup of Rights in the Context of Social Protection, UN Doc. A/HRC/C/50/38 (2022), para. 10.

[56] Ibid., para. 13.

[57] Ibid., para. 43.

[58] Ibid., paras. 18, 70.

[59] Universal Declaration of Human Rights, G.A. Res. 217A (III) (1948), arts. 22, 25; International Covenant on Economic, Social and Cultural Rights, G.A. Res. 2200A (XXI) (1966), art. 9. See also International Convention on the Elimination of All Forms of Racial Discrimination, G.A. Res. 2106A (XX)

(1965), art. 5(e)(iv); Convention on the Elimination of All Forms of Discrimination against Women, G.A. Res. 34/180 (1979), arts. 11(1)(e), 11(2)(b), 14(2); Convention on the Rights of the Child, G.A. Res. 44/25 (1989), arts. 26, 27(1)–(3); International Convention on the Protection of the Rights of All Migrant Workers and Their Families, G.A. Res. 48/148 (1990), arts. 27, 54; Convention on the Rights of Persons with Disabilities, G.A. Res. 61/106 (2006), art. 28.

[60] Notably, Universal Declaration of Human Rights, G.A. Res. 217A (III) (1948), arts. 25(1)–(2), 26; International Covenant on Economic, Social and Cultural Rights, G.A. Res. 2200A (XXI) (1966), arts. 10, 11, 12, 13, 14.

[61] Notably, Universal Declaration of Human Rights, G.A. Res. 217A (III) (1948), arts. 23, 24; International Covenant on Economic, Social and Cultural Rights, G.A. Res. 2200A (XXI) (1966), arts. 6–8.

[62] Committee on Economic, Social and Cultural Rights, General Comment No. 19, UN Doc. E/C.12/GC/19 (2008), paras. 9–39.

[63] Ibid., para. 2.

[64] Ibid., para. 22.

[65] Ibid., paras. 23–27.

[66] Ibid., paras. 32–39.

[67] Ibid., para. 4.

[68] Ibid., para. 3.

[69] Committee on Economic, Social and Cultural Rights, Concluding Observations: Serbia, UN Doc. E/C.12/SRB/CO/3 (2022), para. 3; El Salvador, UN Doc. E/C.12/SLV/CO/6 (2022), para. 21; Italy, UN Doc. E/C.12/ITA/CO/6 (2022), para. 20; Bosnia and Herzegovina, UN Doc. E/C.12/BIH/CO/3 (2021), para. 13; South Africa, UN Doc. E/C.12/ZAF/CO/1 (2018), para. 16; Pakistan, UN Doc. E/C.12/PAK/CO/1 (2017), para. 16; Republic of Korea, UN Doc. E/C.12/KOR/CO/4 (2017), para. 12; Honduras, UN Doc. E/C.12/HND/CO/2 (2017), para. 20.

[70] International Labour Organization, Social Protection Floors Recommendation, ILO R202 (2012), para. 3.

[71] A. Nußberger, “Evaluating the ILO’s Approach to Standard-Setting and Monitoring in the Field of Social Security,” in E. Riedel (ed), Social Security as a Human Right (New York: Springer, 2007), p. 110.

[72] M. Kaltenborn, “The Human Rights Framework for Establishing Social Protection Floors and Achieving Universal Health Coverage,” M. Kaltenborn, M. Krajewski, and H. Kuhn (eds), Sustainable Development Goals and Human Rights (Cham: Springer, 2020) p. 38.

[73] International Labour Organization (2012, see note 70), para. 5.

[74] Committee on Economic, Social and Cultural Rights (2008, see note 62), para. 59.

[75] B. Goldblatt, “Economic Inequality and the Right to Social Security: Contested Meanings and Potential Roles,” in D. F. Frey and G. MacNaughton (eds), Human Rights and Economic Inequalities (Cambridge: Cambridge University Press, 2021), p. 308.

[76] International Labour Organization (2012, see note 70), para. 13.

[77] Ibid., para. 3.

[78] M. Bierbaum and V. Schmitt, “Investing Better in Universal Social Protection: Applying International Social Security Standards in Social Protection Policy and Financing,” ILO Working Paper 43 (January 2022), pp. 21–22.

[79] United Nations Research Institute for Social Development, Combating Poverty and Inequality: Structural Change, Social Policy and Politics (Geneva: United Nations Research Institute for Social Development, 2010), p. 135.

[80] Ibid., p. 137.

[81] J. A. Ocampo and N. Gomez-Arteaga, “Social Protection Systems, Redistribution and Growth in Latin America,” Revista CEPAL 122 (2017).

[82] Ibid., pp. 21–22.

[83] United Nations Research Institute for Social Development (see note 79), p. 142.

[84] Ibid.

[85] W. Korpi and J. Palme, “The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality and Poverty in the Western Countries,” LIS Working Paper Series, No. 174 (1998).

[86] Ocampo and Gomez-Arteaga (see note 81), p. 23.

[87] F. Calligaro and O. Cetrangolo, “Financing Universal Social Protection: The Relevance and Labour Market Impacts of Social Security Contributions,” WIEGO Working Paper No. 47 (2023), p. 3.

[88] Ibid., p. 4.

[89] World Bank, World Development Report 2019: The Changing Nature of Work (Washington, DC: World Bank, 2019), pp. 106–115.

[90] International Labour Organization, “International Labour Office Expresses Concern about World Bank Report on Future of Work” (October 12, 2018), https://www.ilo.org/global/about-the-ilo/newsroom/statements-and-speeches/WCMS_646884/lang–en/index.htm.

[91] International Labour Organization, Extending Social Security to Workers in the Informal Economy: Lessons from International Experience (Geneva: International Labour Organization, 2021), p. 19.

[92] S. Plagerson and M. S. Ulriksen, “Can Social Protection Address Both Poverty and Inequality in Principle and Practice?,” Global Social Policy 16/2 (2016), p. 183; Goldblatt (see note 75), p. 304.

[93] K. Hujo, “Social Protection and Inequality in the Global South: Politics, Actors and Institutions,” Critical Social Policy 41/3 (2021), p. 345.

[94] Goldblatt (see note 75), p. 297.

[95] S. Devereux and J. A. McGregor, “Transforming Social Protection: Social Justice and Human Wellbeing,” European Journal of Development Research 26 (2014).

[96] United Nations Research Institute for Social Development (see note 79), pp. 207–208.

[97] Ibid., p. 144.

[98] Plagerson and Ulriksen (see note 92), pp. 195–196.